Happy new year! How are your new year’s resolutions going so far? Many people go into a new year with so many hopes for a better year…and, after the past two we have had, a year with less drama and more happiness would be great. Don’t you think? 😊 Thinking about resolutions, many people set goals in the new year to lose weight, try new things, make more time for family and friends, save and go on a vacation, pay down debt, etc. Many of these resolutions, though, come with a cost. To lose weight you need to sign up for gym membership or pay for an app. A family tip costs $$$, as does trying new things. But, if you find yourself struggling to set and stick with a budget, you may find that you can’t keep the resolutions that you made for 2022. Before you give up on them, as they seem unattainable, why not consider first looking at putting together a budget that will work for you and not against you. Once you see where all your money is going and make adjustments, you can see that many of your resolutions can be achieved, and 2022 can be a great year.

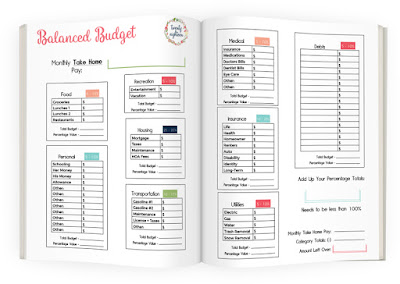

When you think about a budget, you may find yourself getting overwhelmed. First, breath, and then sit down and start listing out how much money you bring in each month. Then, list out expenses including rent/mortgage, car loans, insurance for car and home, utilities, food, leisure activities, etc.

Seeing where your money

goes to each month will give you a better idea of money you have to put towards

your new year’s resolutions, as well as maybe areas you can cut down.

Say you find yourself going out to eat 3-4 days a week for

lunch or dinner. Maybe you can scale it

back to 1-2 days, by utilizing an air fryer or crock pot for convenient

cooking. Or, double a meal so you have

leftovers. I have found that using

online meal subscription programs like Everyplate and Dinnerly, I can save on

my week food expenses, as well as cut down on trips to the market where I find

myself buying more than what was on my list, taking time away from other things

I could be doing, and also the gas back

and forth. I can get a week’s worth of

meals for my family using these online meal subscription sites for under $80. I usually spend close to this on take out for

a family of 4. And, if we dine in someplace, I have to add on a tip.

With mortgage rates still low, may now is the time to refinance

your home loan. We did this last year

and went from 5% all the way down to 3% and have been saving around $110 a

month. Also, we shopped around for better car and home insurance rates and

found a new lender who was able to bundle both, and that saved us close to $100

a month. Like many people, we finally

gave in and got rid of cable last year, which was costing us over $250 for

cable boxes in 4 rooms along with the service and add on channels. We put Roku devices in each room and now use a

few streaming services, which in total cost around $40 a month, and offer live

TV channels and lots of movies and old TV series to enjoy. Thanks to Covid, we have not been going to

the movies, which used to run over $80 for tickets and snacks. Now, we have

family movie night every Friday night, making homemade pizza and enjoying fresh

popped popcorn with our movie. No need

to try and sneak in candy or snacks. And, we can pause the movie if someone

needs to run to the bathroom. Little things

like enjoying a movie at home instead of going to a movie theater will save you

money, and will add up to savings over time, if you are a frequent in-person

movie goer.

If you have a new year’s resolution to get into shape, why

not consider one of the many online exercise streaming platforms available?

Many offer a trial period to see if you like it, and most are under $15 a

month. You can even find some great

exercise videos on YouTube. My husband

uses a few different yoga apps that offer free yoga videos and pays $12 a month

for live and recorded fitness instruction.

This is cheaper than paying and locking yourself into a gym membership…and,

you are saving $$ on gas and time driving back and forth.

If you find you have a lot of credit card debt, why not try

and combine some of your debt with those 0% APR offers you get each month in

the mail By consolidating your debt and

having 12+ months to pay off without incurring interest during that time, you will

finally be able to pay down those credit card debts, and actually see them

going down. Many people have high APR rates, so if they send it $150 a month

for a bill, they could easily see $80-90 going towards interest, and only

$70-80 going to pay down the debt. You

could also try contacting your credit card companies to see if they have any

offers available to help pay down your debt.

Or, better yet, click here for ways to consolidate your debt, and pay it off once and for all. Just imagine how much money you will save and

keep in your pocket each month, once you finally pay off all your credit card

debt.

Once you have all your expenses listed out, you can have a

clearer picture of things, and then start looking for ways you can save, like

some of the suggestions above. Slowly

you will find yourself saving a few dollars here and there, and it will add up

to a greater savings each month and in the long run. And, that savings, could go towards bigger goals

or resolutions you may have. Also, once

you create a budget and stick with it, you will find yourself stressing less each

month wondering if you will have to live paycheck to paycheck, or thinking you

just work and can’t have any fun. You

can have fun…but, first you need to put together a realistic budget that will

work for you and that is manageable.

Make sure you leave room for unexpected expenses like a car repair or

medical bill, as it is always good to have a rainy-day fund on hand if you ever

find yourself needing money to pay for these bills.

No comments :

Post a Comment